The banking system in Brunei Darussalam exhibits a dual structure, comprising Islamic and conventional banks. Additionally, there is an Islamic trust fund established under its own statute within the country’s financial framework.

According to the initial semi-annual policy statement released by the Brunei Darussalam Central Bank (BDCB) in July 2023, the Monetary Authority of Singapore (MAS) adopted a tighter monetary policy stance in 2022, impacting Brunei Darussalam due to the one-to-one parity of the Brunei dollar to the Singapore dollar.

This move helped mitigate the effects of imported inflation on Brunei’s prices. In April 2023, MAS decided to maintain its current policy stance, expecting the ongoing effects of previous tightening to further lower inflation. Considering these factors and consumer price index (CPI) data, the Brunei Darussalam Currency Board forecasts inflation within the range of 1.0 per cent to 2.0 per cent for 2023.

To encourage domestic money market activities amid rising interest rates, the Financial and Monetary Stability Committee (FMSC) raised the BDCB Overnight Standing Facility rates twice in February and March 2023. The Lending Ratio increased to 4.0 per cent, while the Deposit Rate remained at 1.5 per cent by the end of June 2023. This aims to align BDCB’s monetary operations with Currency Board principles and ensure support for a well-functioning domestic financial system.

In Q1 2023, Brunei Darussalam’s financial sector experienced a slight decline of 0.3 per cent year-on-year (y-o-y) in total assets to BND23.9 billion. Islamic finance held BND14.1 billion (59.1 per cent of total assets). Deposit-taking institutions represented 91.9 per cent of total financial sector assets, totalling BND 21.9 billion.

The banking sector demonstrated resilience and stability, with an aggregate Capital Adequacy Ratio (CAR) of 21.3 per cent, well above the regulatory minimum of 10.0 per cent. Liquidity remained high, with a Liquid Assets-to-Total Assets ratio of 48.1 per cent. Overall assets increased by 1.2 per cent y-o-y to BND20.0 billion, and deposits improved slightly to BND 16.9 billion.

Banks sustained credit flows, with total loans/financing growing by 1.9 per cent y-o-y to BND6.3 billion in Q1 2023. However, the Net Non-Performing Loans/Financing (NPLF) ratio increased to 1.9 per cent from 1.7 per cent in Q1 2022, indicating a slight deterioration in asset quality.

To manage systemic risks, identified Domestic Systemically Important Banks (D-SIBs) for 2023 faced additional policy measures, including Higher Loss Absorbency (HLA) capital requirements to enhance their resilience.

As part of Brunei’s FinTech strategy, BDCB joined the Global Financial Innovation Network (GFIN) in March 2023. This membership aims to connect Brunei to the global FinTech ecosystem and foster collaboration with other GFIN members.

BANK ISLAM BRUNEI DARUSSALAM

Steering Towards a Sustainable Tomorrow

Bank Islam Brunei Darussalam (BIBD), the nation’s largest bank and premiere Islamic financial institution, is seeking to redefine the future of banking with its digital-first approach. As the digital wave sweeps across the globe, BIBD is harnessing its power to not only enhance banking experiences but also to pave the way for a sustainable horizon.

The Advent of Olive: A Digital Transformation Milestone

BIBD’s digital journey reached a significant milestone with the launch of Olive, an innovative digital banking platform that is first being implemented for BIBD At-Tamwil Berhad. Officially launched in July 2023, Olive represents the peak of banking convenience, allowing customers to perform banking transactions anytime, anywhere, without the need for physical bank visits. This initiative is a testament to BIBD’s commitment to digital innovation, with Olive onboarding over 21,000 customers shortly after its launch, reflecting its rapid acceptance and the bank’s aim to transition at least 90 per cent of its customer base to digital banking by 2025.

Olive is not just a digital banking app but a comprehensive ecosystem that simplifies banking processes, making financial services more accessible and fostering financial literacy among Bruneians. The platform is a part of BIBD’s broader strategy to ensure that digital banking is synonymous with security and convenience, incorporating advanced safety measures such as e-KYC, dynamic identification, and robust customer authentication mechanisms.

Go Digital! Campaign: Echoing the Call for Sustainability

Parallel to the technological advancements with Olive, BIBD has been actively promoting their “Go Digital!” campaign, underscoring the bank’s dual commitment to digitalisation and sustainability. This initiative highlights the environmental benefits of digital banking, such as reduced paper use and carbon emissions, aligning with Brunei’s vision of a sustainable future. The campaign is a call for Bruneians to embrace digital banking, not just for its convenience but also for its positive impact on the environment.

A Vision Anchored in Sustainability

At the heart of BIBD’s digital transformation is its Sustainability Framework, a strategic blueprint that commits BND2 billion towards sustainability funding by 2030. This framework is built on the pillars of Environmental Protection, Responsible Entrepreneurship, and Inclusive Social Impact, intertwining BIBD’s digital initiatives with its sustainability goals. The bank’s efforts are in harmony with the global sustainability movement and the Maqasid Syariah principles, emphasising the role of financial institutions in fostering a greener, more equitable world.

BIBD’s Digital-Sustainability Nexus: A Model for the Future

BIBD’s digital banking endeavours, highlighted by the Olive platform and the “Go Digital!” campaign, are more than just technological advancements; they are steps towards a sustainable future. By integrating digital innovation with its sustainability objectives, BIBD is not only enhancing customer experiences but also contributing to the environmental well-being of Brunei and beyond. This holistic approach positions BIBD as a leader in the digital banking sphere, setting a precedent for how banks worldwide can embrace technology to foster sustainable development.

Embracing Change, Ensuring Progress

As BIBD continues on its digital journey, the message is clear: embracing digital transformation is not an option but a necessity in today’s rapidly evolving world. With initiatives like Olive and the “Go Digital!” campaign, BIBD is ensuring that its customers and the community at large are equipped to thrive in the digital age, all while contributing to a sustainable future. The bank’s commitment to innovation, security, and sustainability serves as a beacon for others, demonstrating how digital waves can indeed lead to sustainable horizons.

BAIDURI BANK

Established in 1994, Baiduri Bank is a member of the Baiduri Bank Group, one of the largest providers of financial products and services in Brunei Darussalam. Baiduri Bank’s vision is to become the leading and preferred financial partner, empowering individuals and businesses to achieve financial success in a changing world.

Following the Standard & Poor’s (S&P) rating upgrade to A-/A-2 with a stable outlook in June 2022, Baiduri Bank secured its position as a prominent conventional bank in Brunei and a strong player in the region. The bank’s ability to maintain an A-/A-2 issuer credit rating with a stable outlook from S&P Global Rating in July 2023 signifies its continued importance in the country’s banking sector.

Global recognition

Baiduri Bank has been recognised internationally, accumulating prestigious awards that consolidate its position as a trusted industry leader in the financial sector. Leveraging the resilience and momentum gained in recent years, Baiduri Bank demonstrated significant growth in key business areas, achieving robust financial performance and aligning closely with its objectives.

Chief Executive Officer Ti Eng Hui credits these achievements to the bank’s diversified income streams and persistent dedication to excellence. “We are immensely proud of the recognition Baiduri Bank has received in the recent years. These accolades are a testament to the bank’s unwavering commitment to excellence in service, innovation, and our consistent efforts in strengthening our financial services.”

Forging ahead in digital Transformation

Innovation remains the cornerstone of progress for Baiduri Bank in the ever evolving banking landscape. Committed to delivering exceptional banking experience for customers, the bank has been strategically investing in emerging technologies to enhance its data analytics, product management, operational efficiency and customer service capabilities. Since 2020, the bank has been focusing on its digital transformation journey, embracing cutting-edge technologies to enhance customer experience.

The bank’s commitment to digital innovation is evident in its strategic partnerships with Finbots.ai to modernise credit risk management using artificial intelligence (AI), and with Temenos, the world’s leading open platform for composable banking, to run its core banking services on a software-as- a-service (SaaS) platform in the cloud. These collaborations make Baiduri Bank the first in Brunei to adopt an AI-led credit risk solution and first bank in Brunei to operate its core banking platform in the cloud under the SaaS model.

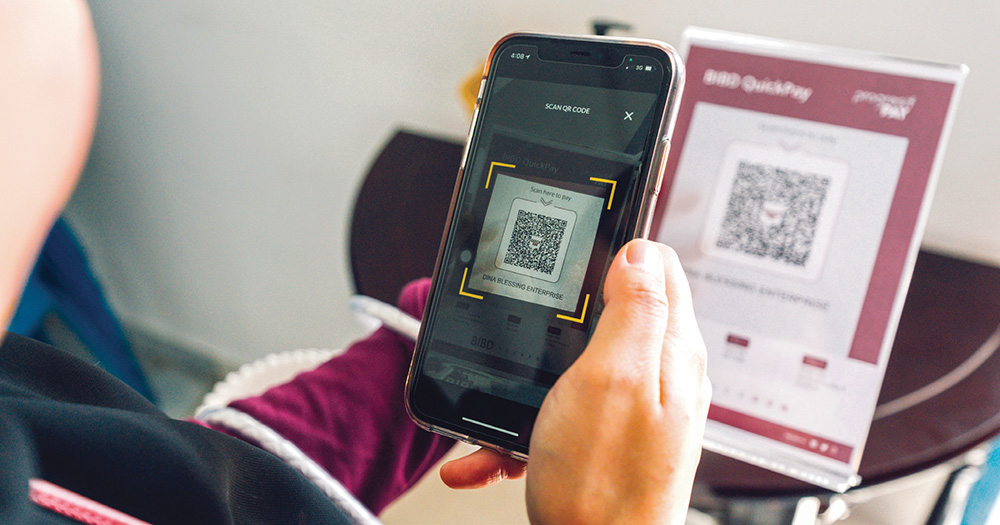

Continuing to deliver digital-first experiences, the bank launched Baiduri Qpay in 2023, a digital wallet that allows its UnionPay Debit Cardholders to easily scan and pay at participating outlets both locally and abroad. This feature complements the suite of digital payment services offered by Baiduri Bank, aligning with Brunei’s Digital Economy Masterplan 2025.

Additionally, the eMarketplace initiative, Maribali, was launched to support local micro, small and medium enterprises (MSMEs), offering an online platform for local MSMEs to market and sell their products and services online with secure and convenient on-the-go payment options.

Strengthening community ties

Guided by the brand promise, ‘co-creating your future,’ Baiduri Bank aspires to be active and caring community members, showcasing leadership and striving for sustainable development through its corporate social responsibility (CSR) initiative through three key pillars: Social, Economic and Environmental.

Socially, Baiduri Bank has been an active community partner, focusing on community welfare and empowering various segments, including people with disabilities and the underprivileged.

In 2023, the bank’s flagship CSR initiative, the Baiduri Masters charity golf tournament, made a notable return. This year’s 25th edition saw generous donations from the sponsors and the bank, enabling the bank to donate 100 per cent of the golfers’ registration fees to four charities: SMARTER Brunei, Learning Ladders Society, YASKA and JAPEM.

Baiduri Bank, in partnership with the Ministry of Culture, Youth and Sports (MCYS), signed a memorandum of understanding (MoU) to further enhance the volunteerism platform Mengalinga. This app connects volunteers with volunteering opportunities and the enhanced version has innovative features like leaderboards and awards to promote active community involvement.

On the economic front, Baiduri Bank continues to cultivate an entrepreneurial culture and enhance financial literacy. Initiatives include the MSME Empowerment Series with Darussalam Enterprise (DARe), boosting local MSMEs and startups. The bank is also the proud sponsor of the Brunei Economy Programme through the TRANSFORM series and Asia Inc Forum.

The launch of Baiduri Enterprise Hub, a co-working space equipped with modern amenities for entrepreneurial activities, further supports this objective. Partnerships with DARe, the Authority for Info-communications Technology Industry of Brunei Darussalam (AITI), Shell LiveWIRE Brunei and Young Entrepreneurs Association Brunei (YEAB) also enhance the Hub’s role in fostering business development and collaboration.

The launch of Baiduri Enterprise Hub, a co-working space equipped with modern amenities for entrepreneurial activities, further supports this objective. Partnerships with DARe, the Authority for Info-communications Technology Industry of Brunei Darussalam (AITI), Shell LiveWIRE Brunei and Young Entrepreneurs Association Brunei (YEAB) also enhance the Hub’s role in fostering business development and collaboration.

Under the environmental pillar, Baiduri Bank focuses on promoting zero-waste and low-impact living and supporting green businesses and activities. Baiduri Bank proudly hosted the rooftop edition of Baiduri Lokal Market 2023, organised in collaboration with the Department of Environment, Parks and Recreation (JASTRe). The event highlighted the mounting issue of electronic waste (e-waste) and hosted educational booths to discuss e-waste production, recycling and proper disposal methods.

Empowering people for future success

Engaged and empowered employees passionately contribute to the success of their workplace, propelling it to new heights. At Baiduri Bank, people development is a foundational pillar towards delivering outstanding business outcome. Baiduri Bank adopted a systematic approach to talent management by identifying, developing and nurturing its talents to be potential leaders and equipping them with future-ready skills to support the bank’s digital aspirations. Initiatives such as the Leadership Forum, Leadership Academy, and Emerging Leaders Mentoring Programme and staff-driven Employee Wellness Initiative (EWI) ensure a dynamic and skilled workforce that are primed for excellence in their work.

A future of innovation and sustainable growth

As Baiduri Bank continues to evolve, it remains dedicated to its vision of empowering individuals and businesses in a changing world. Through its initiatives in digital transformation, people development and community engagement, the bank is not only contributing to Brunei’s economic prosperity but also setting a benchmark for responsible and innovative banking in the region, exemplifying how financial institutions can play a pivotal role in shaping a sustainable future.

STANDARD CHARTERED BANK

Award-winning wealth management solutions

Standard Chartered Bank has always been a market leader in wealth management having established offerings in Brunei more than 20 years ago. The bank opened its first wealth management centres in September 2006 in both Gadong and Kuala Belait.

It was the first bank to introduce dual currency investment products, namely Premium Currency Deposit. Following the implementation of the Securities Market Order by the then Autoriti Monetari Brunei Darussalam, Standard Chartered Securities (B) Sdn Bhd (SCSB) was established and wholly owned by Standard Chartered PLC through its subsidiaries Standard Chartered Bank (UK) and Standard Chartered Nominees Ltd (UK).

SCSB is licensed by the Brunei Darussalam Central Bank as a Capital Market Service Licence holder to distribute investment products and provide investment advice as a financial planner and investment adviser to both retail and accredited investors.

Last year, SCSB bagged two awards, namely Outstanding Transformation in Digital CX by a Wealth Manager and Best Wealth Management Platform. The awards reflect the commitment of SCSB to continue providing the bank’s clients and the wider community, products and services to enhance their wealth in line with their priorities and values.

Building wealth in line with what matters most

SCSB introduced Islamic Investments through an industry-first Islamic Window in April 2021. Through this milestone development in the financial sector, SCSB began offering Syariah compliant investments for clients who wished to invest in line with their belief and values.

In addition to Islamic investments, SCSB was also the first in the market to introduce Environment, Social and Governance (ESG) focused funds bringing sustainability into the focus and enabling clients with the ability to make a difference without compromising on returns on their portfolio.

Global expertise, local Touchpoints

SCSB has always placed an emphasis on offering expert advisory services and support to provide tailored solutions to clients for them to make the best informed decisions for their wealth aspirations.

Standard Chartered implemented stringent certification standards of its wealth consultants team since 2006 following global standards.

Following the implementation of the Securities Market Order, all SCSB relationship managers, wealth consultants and investment counsellors are fully licensed in addition to internal training certifications.

Its team of relationship managers and wealth consultants are supported by investment counsellors to serve affluent and personal banking clients for all their wealth management needs.

The local teams are further supported by global research and investment specialists through the Standard Chartered network providing timely market outlook and global survey/report insights.

Making wealth management and investing accessible

Over the years, there has been an increased interest in investing and financial literacy past the normal array of deposit products.

With minimum investment requirements starting from as low as BND1,000 lump sum or BND100 per month for Regular Savings Plans, investing is accessible for everyone, breaking the preconception that the investing is limited only to the rich or affluent.

With awareness and accessibility becoming a focus for SCSB, clients and even non-clients can access various capabilities to increase their knowledge in the wealth space.

The Interactive Fund Library is a platform that empowers clients to make more informed decisions with access to fund comparison and key fund information. Meanwhile, SC Money Insights is a podcast series created to bring clients the latest market views on the go. Clients also gain global resources to analyse the financial markets around the world with featured articles such as Global Market Outlook, Weekly Market Views and Market Watch.

The SCSB global team of experienced fund analysts apply a “3P” framework: Performance, People and Process for fund due diligence. The outcome is a list of Fund Select funds which are selected based on the merits of their performance, manager expertise and investment process.

In addition, SCSB regularly hosts market outlook and informative events/ webinars for clients to keep them up to date on market trends and movements in addition to providing non-obligatory themed financial planning talks for the wider community to give insights on growing wealth and savvy financial habits.

SCSB hosts a library of wealth insights content on its website featuring easy to digest financial tips and investing foundation basics while also regularly featuring financial tips and advice via social media channels and through its weekly column in the main daily English paper.

SCSB is the only capital markets license holder where clients can view their investment portfolio via its award winning SC Mobile App or via Online Banking.

Existing clients have the convenience of subscribing to new investment with their relationship manager or wealth consultant over the phone or email instructions, thereby freeing up clients’ time to visit branches physically, a process enhancement gleaned from the pandemic period. In addition, clients can also consult with their relationship manager or wealth consultant through video calls for ease of convenience.

PERBADANAN TAIB

Perbadanan TAIB was established under the Perbadanan Tabung Amanah Islam Brunei Act in 1991, offering Syariah compliant basic saving products, Tekad Haji account and personal financing solutions. Its subsidiaries include Insurans Islam TAIB Holdings Sdn Bhd, Darussalam Holdings Sdn Bhd, and TAIB Filling Station Sdn Bhd, established to address the increasing demand for Syariah compliant financial solutions.

Over the years, Perbadanan TAIB has expanded its core mission to improve the financial well-being of Brunei Darussalam’s population while adhering to Syariah principles. This expansion has led to the introduction of various banking products and services, including digital banking (TAIBVX), merchant services such as ScanToPay (STP) and External Payment Interface (EPI), corporate deposits and financing products as well as debit and credit card services.

Sustainability

While Sustainable and Syariah approaches to financing and investing may have been developed independently, both focus on the long-term outlook and overall equitable community well-being.

Perbadanan TAIB has ensured its products and services prohibit riba (interest). Through Syariah compliant financing, return can only be earned on risk-taking activities as long as the burden and/or reward is shared between the financial institution and its customers. Perbadanan TAIB has also ensured that its investment and financing dealings are socially responsible not only in terms of the Syariah principles but also addressing wider community concerns which also forbid Muslims from dealings of addictive substances such as alcohol, gambling and tobacco.

Perbadanan TAIB also aspires to help customers achieve their financial goals. Launched in 2022, TAIB Retirement Saver account assists Bruneians with saving for their retirement and achieving financial security. This product is also available to foreigners working in the country.

Another initiative that brings together sustainability and religious obligations is its efforts to facilitate the Muslim Zakat payment. Perbadanan TAIB offers a digitally calculated service for Zakat on savings accounts to fulfil Zakat obligations conveniently and effectively.

Perbadanan TAIB has also taken significant strides towards promoting sustainable development and green technology. Its data centres integrate energy-saving measures to reduce energy consumption, and leveraging digital technology has led to reduced paper waste at Perbadanan TAIB.

Furthermore, Perbadanan TAIB recently adopted a cloud-based approach for some of its business operations and productivity tools. This strategy has made Perbadanan TAIB more agile, with seamless online collaboration and improved flexibility and scalability, ensuring easy expansion based on business needs.

Four pillars

Since 2020, Perbadanan TAIB has revamped its core missions, focusing on four key directions.

The primary strategic direction entails offering innovative Islamic banking and financial products and services, with a focus on digital transformation. In order to establish itself as a premier provider of Syariah compliant financial solutions, Perbadanan TAIB has transitioned to a comprehensive digital system.

In 2021, Perbadanan TAIB upgraded its core banking system and established a data centre with industry-standard redundancy measures. This advancement enabled the introduction of new mobile banking applications and online account management tools. Strategic partnerships with leading FinTech firms in 2022 further bolstered Perbadanan TAIB’s digital banking abilities.

The introduction of TAIB Virtual Experience (TAIBVX) has notably increased registered users since December 2021, allowing customers seamless access to account management online.

Furthermore, Perbadanan TAIB collaborates with the government and financial institutions to support Brunei Darussalam’s economic growth, notably contributing to the National Digital Payment Network’s development, set to revolutionise digital payment services in the country.

The second strategic focus centres on upholding the highest standards of governance, compliance, and information security. Through regular audit reviews, assessments, and adherence to industry best practices, Perbadanan TAIB has fortified its IT Governance Framework and achieved Payment Card Industry Data Security Standard (PCI DSS) Certification Version 3.2.1 for Debit Card Issuing Services and Card Data Environment.

The third strategic direction emphasises human resource (HR) transformation. Comprehensive training and upskilling programmes ensure employee wellbeing and development, supplemented by interdepartmental training courses covering Risk Management, Product and Services, AML and IT awareness.

Lastly, the fourth strategic focus revolves around enhancing synergy and collaboration between Perbadanan TAIB and its subsidiaries. Participation in roadshows and events as a group underscores the commitment to providing holistic Syariah compliant banking and insurance solutions, with a focus on supporting the Muslim community in fulfilling their haj obligations.

Focus on digital transformation

With a strong emphasis on customer centricity, enhancing digital banking experiences remains a paramount objective through automation and data analytics. Perbadanan TAIB remains steadfast in its commitment to advancing its digital transformation journey by strategically investing in data driven technologies such as blockchain, artificial intelligence, and machine learning.

Perbadanan TAIB is also dedicated to enhancing its data analytics capabilities and leveraging business intelligence to gain actionable insights and improve forecasting accuracy.

Collaboration with the government, government-linked companies (GLCs) and fellow financial institutions is a key focus area, supporting initiatives outlined in the Digital Economy Masterplan 2025. As a pivotal contributor to the national digital payment hub (NDPX) in Brunei Darussalam, Perbadanan TAIB proudly leads the deployment of network services, driving sustainable economic growth in the digital era.