74

Borneo Bulletin Yearbook 2020

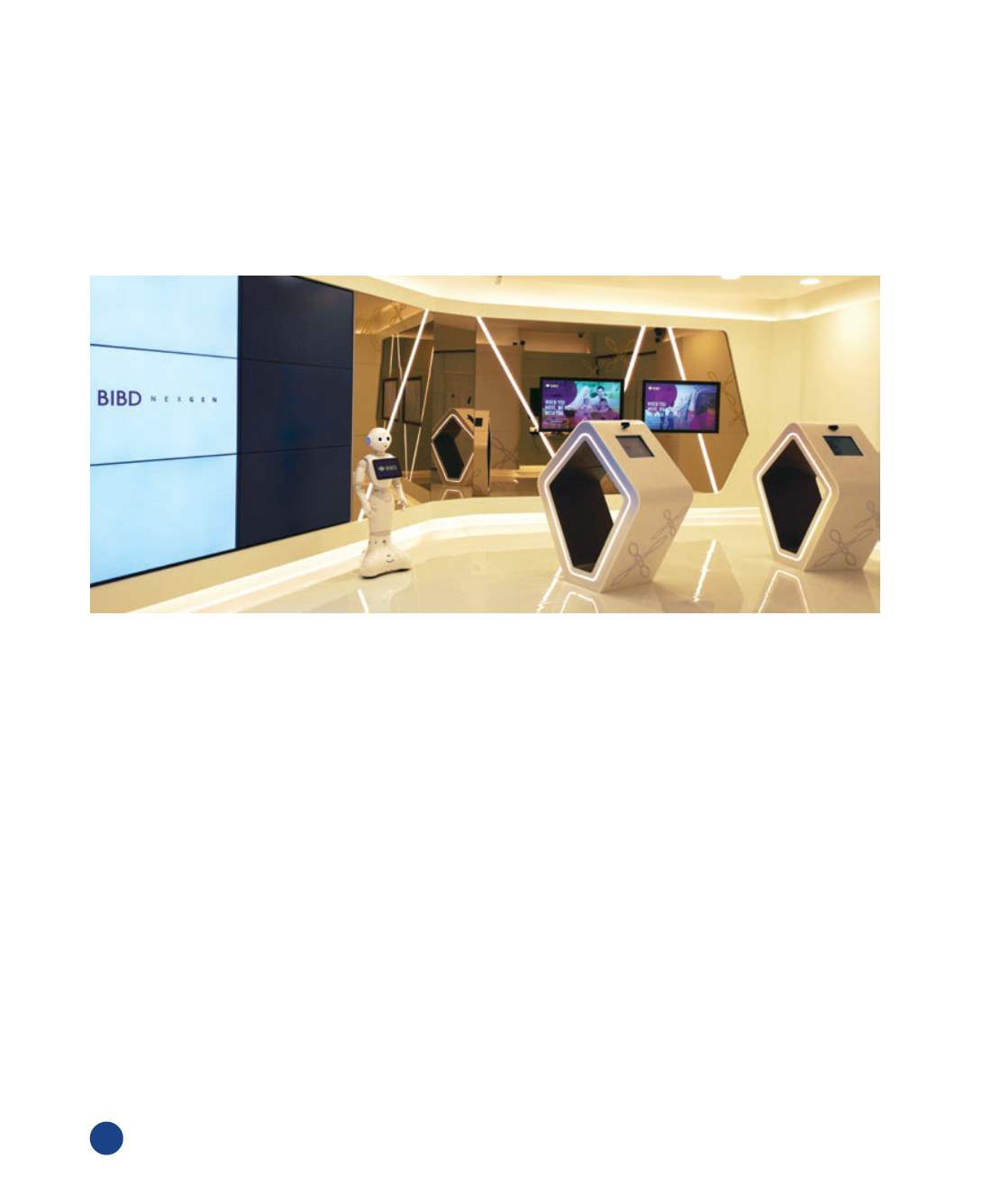

BIBD drives smart nation goal with branchless

banking initiatives

In this age of digital and cashless economy, Bank

Islam Brunei Darussalam (BIBD) as the nation’s

largest bank has always been at the forefront in

digital innovation, being one of the pioneering

banks to envision the future of the banking

ecosystem and branchless banking initiatives.

Branchless banking, a concept which seemed

far-fetched in the Sultanate back then, has

now become a standard and crucial component

in financial products and services offerings.

Defined as the delivery of financial solutions

outside conventional bank branches, this

concept allows customers to complete all

their banking needs without ever having to go

to the bank, and this is made possible through

technologies such as online, over the phone,

through point-of-sale systems, and ATMs,

among others.

With Brunei Darussalam’s high Internet and

mobile penetration, where 93 per cent of the

population has Internet access and 83 per cent

connecting to the Internet through their phones,

BIBD believes that there are still plenty of

opportunities that remain untapped.

BIBD’s branchless banking initiative takes on

a whole-of-nation approach, allowing for the

implementation of BIBD’s state-of-the-art

digital technologies in industries beyond the

banking sector, to enable the expansion of a

larger digital audience.

This amplification of a wider customer experience

provides opportunities for all mobile users to

avail of the technology which will promote

mass adoption of a robust digital ecosystem

in Brunei and enables increased de-cashing of

the economy through secure, innovative and

documented digital payments.

BIBD has always been on the frontier of digital

payment initiatives. Back in 2012, the bank

introduced the first iteration of their mobile

banking app and saw close to 17,000 downloads

in the first six months. Offering the ability to

instantly transfer funds and make payments,

the app recorded over 30,000 transactions per

month. In 2013, BIBD introduced a first of its

kind mobile payment service called eTunai,

enabling customers to make payments directly

through the app, either from their accounts or

by using accumulated BIBD’s reward points

known as Hadiah Points, simply by scanning

a QR code placed on merchant counters. This

service has evolved over the years to be BIBD

QuickPay.