79

BANKING & FINANCE

corporates and SMEs, along with the mass-

market segment,” said Mubashar.

Facilitating Brunei’s Digital Economy

Transformation

BIBD welcomes the digital transformation in

Brunei. In support of Brunei’s gradual transition

into a smart economy, BIBD launched their

mobile-led and data driven digital proposition,

BIBD NEXGEN. The BIBD NEXGEN showcases

the bank’s intent to transform traditional

banking to the fintech age, creating a branchless

banking proposition.

The bank complements their mobile-led

services with a more tangible connection to

customers. BIBD holds the largest and most

readily available network of branches and

ATMs across the country, along with the only

full-fledged contact centre with a mobile chat

feature.

Supporting SMEs and Economic

Diversification

In support of small and medium enterprises

(SMEs) in Brunei, BIBD launched its first SME

360 branch in 2016. The SME 360 caters

specifically to SMEs, offering banking solutions

to grow their business.

To encourage foreign direct investment,

BIBD established the Asian Desk, a platform

for local Bruneian institutions to engage

with international institutions for business

opportunities.

For micro, small and medium enterprises

(MSMEs), BIBD introduced the BIBD MSME

Account. With this account, MSMEs can

manage their businesses and personal

finances separately. The account requires a

lower minimum average and allows access

to a range of facilities and corporate banking

services.

“BIBD believes that success of the country is

where there is progress for everyone. On top

of our own initiatives, we have also made great

strides with our close collaboration with the

government of His Majesty along with other

Bruneian institutions,” said Mubashar.

BIBD facilitated modules for Darussalam

Enterprise

(DARe)’s

Industry

Business

Academy (IBA). In partnership with DARe, BIBD

introduced the Microcredit Financing Scheme

that offers up to BND15,000 for budding

industries. BIBD collaborates with LiveWIRE

Brunei in the Business Awards Start-up Funding

Scheme (BASfs) to inspire talented Bruneian

entrepreneurs.

Helping Customers Achieve Their

Aspirations

BIBD’s corporate social responsibility (CSR)

programmes are designed to uplift communities

and individuals. The programmes are hoped to

create a ripple effect by not only changing an

individual’s life, but also the lives of the people

around them and for the next generations of

Bruneians.

As BIBD’s flagship education initiative, the BIBD

ALAF programme recognises education and

learning as the essentials of individual growth

and national development. Another programme,

the BIBD SEED, is aimed at transforming

underprivileged mothers into successful and

resilient entrepreneurs able to compete in local

and international markets.

To promote the growth of Brunei’s future

industry leaders, BIBD launched its first

community hub, BIBD Connects, which acts

as an engagement platform for communities

and entrepreneurs. BIBD Connects charges a

fraction of the actual market rental.

The bank takes pride in supporting the Autoriti

Monetari Brunei Darussalam (AMBD) to

elevate the awareness and benefits of financial

management. BIBD regularly holds a series of

informative financial management talks with

their certified financial planners.

BIBD Aspirasi is a unique and flexible savings

scheme to cultivate money management. The

savings scheme offers a lucrative reward

programme that encourages customers to save

for their financial future, embedding a ‘wants-

can-wait’ mindset.

The bank continues to expand its presence

and deliver its promise of world-class Islamic

finance products and solutions, while upholding

international standards.

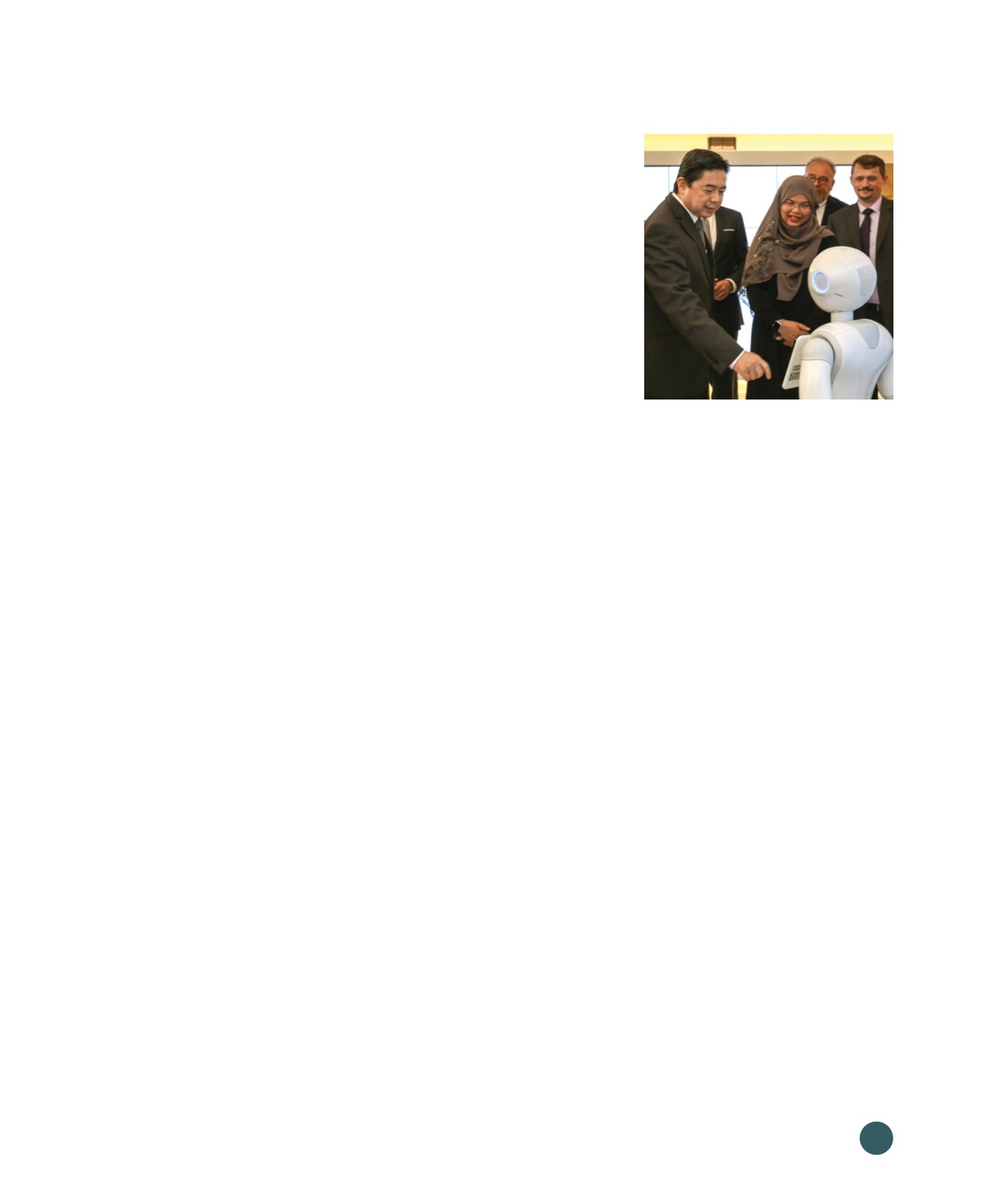

Dato Seri Setia Dr Awang Haji Mohd

Amin Liew bin Abdullah, Minister at

the Prime Minister’s Office and Minister of

Finance and Economy II and Chairman of BIBD

during the launching of BIBD NEXGEN