83

BANKING & FINANCE

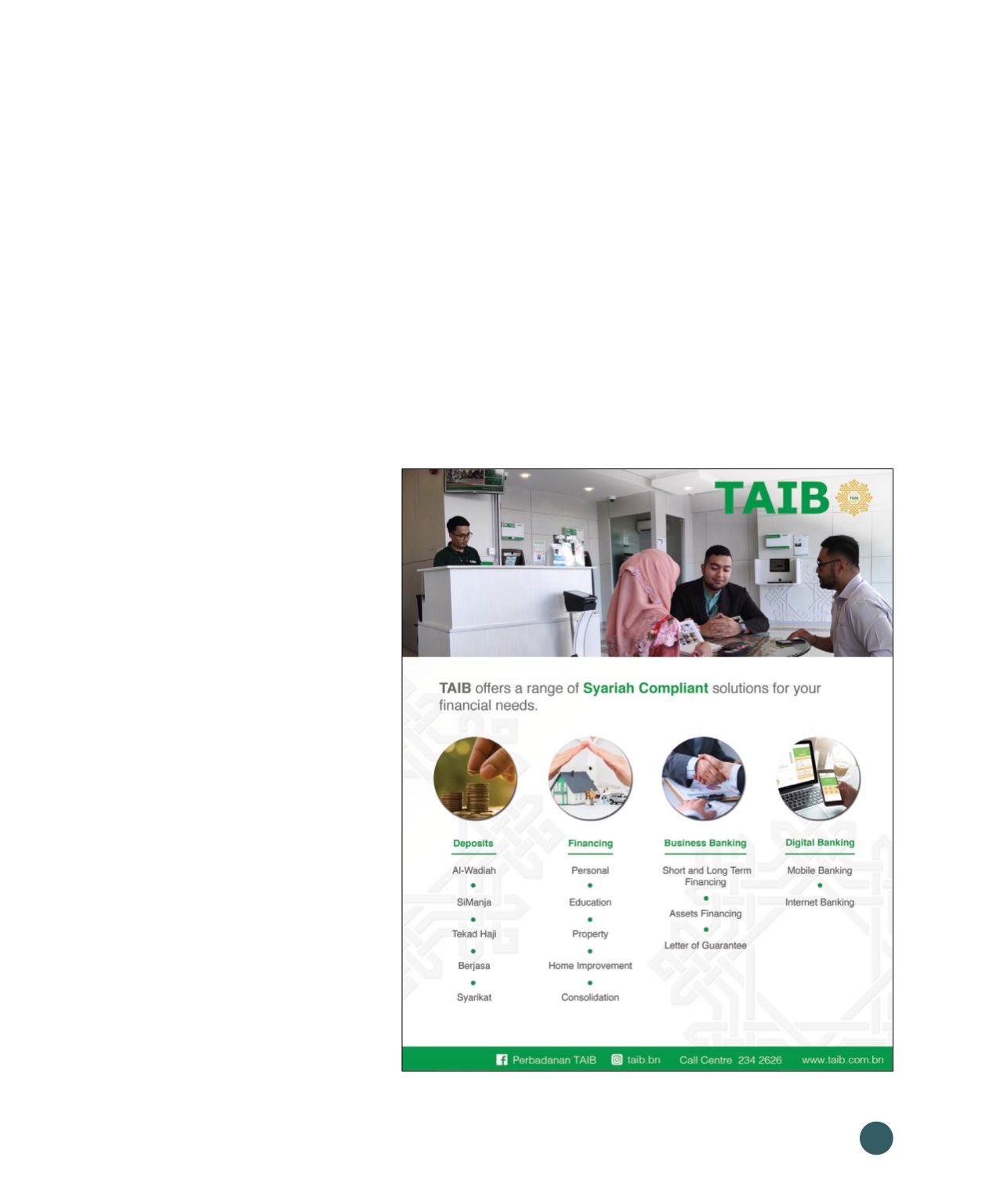

In 1991, Perbadanan Tabung Amanah Islam

Brunei (TAIB) was established and marked the

growth of Islamic financial industry in Brunei.

As the pioneer Islamic banking institution,

Perbadanan TAIB generates a sustainable impact

on the economy and community in compliance

with the Syariah laws.

Perbadanan TAIB offers retail and corporate

financing. There are five subtypes under retail:

Personal, Property, Education, Consolidation and

Home Improvement. After almost three decades

of operations, Perbadanan TAIB has more than

200,000 savings accounts opened with almost

half of Brunei’s population as their customers.

With a dedicated team and smooth operations,

Perbadanan TAIB delivers the top banking

experience. With eight branches and one self-

service centre across the country, Perbadanan

TAIB provides the widest network of dedicated

Islamic banking channels.

Financial technology (FinTech) is an emerging

industry that uses technology to improve

financial services. Perbadanan TAIB welcomes

the growth of digital banking services. In 2016,

Perbadanan TAIB introduced mobile banking

and Internet banking for secure and convenient

banking transactions. The following year,

Perbadanan TAIB opened its first Self Service

Centre in Rimba.

Perbadanan TAIB conducted various programmes

in 2018 including Financial Literacy Talk; and

has participated in Global Money Week and

National Savings Day; as well as Baitul Annam

for the underprivileged. Perbadanan TAIB also

collaborated with AMBD in AMBD’s Financial

Fun Fair, spreading financial awareness.

Small and medium enterprises (SME) are a

major player in Brunei’s economic growth.

Perbadanan TAIB supports local SMEs,

providing financial assistance and training

programmes to nurture local entrepreneurs. The

financial institute catalyses growth of SMEs in

terms of a company’s working capital, assets

acquisition, building construction, contract

and project financing. This is to encourage and

assist the SMEs to modernise and upgrade their

business capacity. Perbadanan TAIB plans to

establish a banking subsidiary as they develop

their infrastructure, products and services.

Islamic finance and rise of financial technology